Q3 2009: Blade Servers and x86 Leading Server Market

With a 1.2% growth, blade servers are leading all others in the market segment that may have made strides in the past. But the IDC research firm sees light at the end of the tunnel: since the bleak period that ended 2008, the revenue curve for the worldwide server market is trending upwards again.

Compared with 2008, the worldwide revenue for the server market declined 17.3% in the third quarter of 2009 to $10.4 billion, which makes the fifth consecutive quarter of a downturn. Server unit shipments fell by almost 18% year over year. Volume shipments fell by almost 15%, with midrange enterprise server revenue falling by more than 23%.

IDC emphasizes, however, that the negative trend in revenue and unit shipments is only half as bad as it was in 2Q09. The second quarter showed a decline of a little over 30%. The market research firm rates the Q3 figures in comparatively positive terms: revenue grew for the first time since 4Q08 and server shipments increased by 12.4% year over year, "the largest sequential unit growth since 2005."

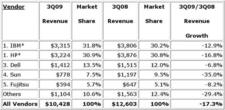

Vendor ranking in 3Q09: IBM slides a whisper ahead of HP since 2008 and Sun is hit comparatively the worst. (Source: IDC)

Vendor ranking in 3Q09: IBM slides a whisper ahead of HP since 2008 and Sun is hit comparatively the worst. (Source: IDC)

Linux servers grew in market share year over year by not quite one percent to 14.8%, with $1.5 billion total revenue among vendors and distributors. The increase was $200 million over the previous quarter, but still almost 13% less than 3Q08. In comparison, the UNIX server revenue came to $2.8 billion, a slight decline since Q2 and more than a 23% cut year over year, representing a market share of just under 27%. The largest revenue share came from Windows machines in 3Q09, with $4.5 billion, but with a similar year-over-year decline at just under 13% as the Linux servers.

IDC found that the x86 processor platform factory revenues grew by 18.7% from quarter to quarter, but still showed a drop of 12.3% year over year. The only growth factor seemed to be the blade server market: compared to last year, factory revenue actually grew by 1.2%, even though shipments declined by 14%. The results show a revenue growth for three quarters in a row, with blade servers the top growth market over the last six months. IDC attributes the blade server success to cost efficiencies due to next generation processors (Intel Nehalem) and increased RAM. Customers use blade servers for new, virtualized environments, considering them "closely associated technologies" and a driving force in the data center of the future.

Subscribe to our Linux Newsletters

Find Linux and Open Source Jobs

Subscribe to our ADMIN Newsletters

Support Our Work

Linux Magazine content is made possible with support from readers like you. Please consider contributing when you’ve found an article to be beneficial.

News

-

LibreOffice 26.2 Now Available

With new features, improvements, and bug fixes, LibreOffice 26.2 delivers a modern, polished office suite without compromise.

-

Linux Kernel Project Releases Project Continuity Document

What happens to Linux when there's no Linus? It's a question many of us have asked over the years, and it seems it's also on the minds of the Linux kernel project.

-

Mecha Systems Introduces Linux Handheld

Mecha Systems has revealed its Mecha Comet, a new handheld computer powered by – you guessed it – Linux.

-

MX Linux 25.1 Features Dual Init System ISO

The latest release of MX Linux caters to lovers of two different init systems and even offers instructions on how to transition.

-

Photoshop on Linux?

A developer has patched Wine so that it'll run specific versions of Photoshop that depend on Adobe Creative Cloud.

-

Linux Mint 22.3 Now Available with New Tools

Linux Mint 22.3 has been released with a pair of new tools for system admins and some pretty cool new features.

-

New Linux Malware Targets Cloud-Based Linux Installations

VoidLink, a new Linux malware, should be of real concern because of its stealth and customization.

-

Say Goodbye to Middle-Mouse Paste

Both Gnome and Firefox have proposed getting rid of a long-time favorite Linux feature.

-

Manjaro 26.0 Primary Desktop Environments Default to Wayland

If you want to stick with X.Org, you'll be limited to the desktop environments you can choose.

-

Mozilla Plans to AI-ify Firefox

With a new CEO in control, Mozilla is doubling down on a strategy of trust, all the while leaning into AI.