Graphic display of portfolio stock values

Sketching Curves

© auris, Fotolia

We'll show you a Perl script that helps you draw area graphs to keep track of your portfolio's performance.

When it comes to wealth management, the performance of a single stock in your portfolio is less important than the overall performance. Although online financial services might give you neat graphs of share price developments for individual stocks, or even a comparison of two values, they do not offer you a tool that lets you monitor the share price development of your complete portfolio at a glance. A Perl script changes this.

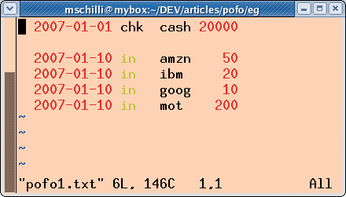

Figure 1 shows the configuration file (pofo1.txt) for a portfolio in a text editor. Each line starts with a date in ISO notation followed by the transaction type – a purchase (in) or a sale (out) – of an individual share, the ticker symbol, and the number of shares. The file also can handle cash transactions; instead of the ticker symbol, you see the word cash.

Figure 1: An investor puts a total of US$ 20,000 into their portfolio in January 2007 (line 1) and uses the money to purchase a mix of Internet shares (the following four lines).

Figure 1: An investor puts a total of US$ 20,000 into their portfolio in January 2007 (line 1) and uses the money to purchase a mix of Internet shares (the following four lines).

[...]

Buy this article as PDF

(incl. VAT)

Buy Linux Magazine

Subscribe to our Linux Newsletters

Find Linux and Open Source Jobs

Subscribe to our ADMIN Newsletters

Support Our Work

Linux Magazine content is made possible with support from readers like you. Please consider contributing when you’ve found an article to be beneficial.

News

-

MX Linux 25.1 Features Dual Init System ISO

The latest release of MX Linux caters to lovers of two different init systems and even offers instructions on how to transition.

-

Photoshop on Linux?

A developer has patched Wine so that it'll run specific versions of Photoshop that depend on Adobe Creative Cloud.

-

Linux Mint 22.3 Now Available with New Tools

Linux Mint 22.3 has been released with a pair of new tools for system admins and some pretty cool new features.

-

New Linux Malware Targets Cloud-Based Linux Installations

VoidLink, a new Linux malware, should be of real concern because of its stealth and customization.

-

Say Goodbye to Middle-Mouse Paste

Both Gnome and Firefox have proposed getting rid of a long-time favorite Linux feature.

-

Manjaro 26.0 Primary Desktop Environments Default to Wayland

If you want to stick with X.Org, you'll be limited to the desktop environments you can choose.

-

Mozilla Plans to AI-ify Firefox

With a new CEO in control, Mozilla is doubling down on a strategy of trust, all the while leaning into AI.

-

Gnome Says No to AI-Generated Extensions

If you're a developer wanting to create a new Gnome extension, you'd best set aside that AI code generator, because the extension team will have none of that.

-

Parrot OS Switches to KDE Plasma Desktop

Yet another distro is making the move to the KDE Plasma desktop.

-

TUXEDO Announces Gemini 17

TUXEDO Computers has released the fourth generation of its Gemini laptop with plenty of updates.